Gilts, or to use their proper term gilt-edged securities, are bonds issued by the government with the money raised being used to finance public spending. They got their name from the certificates that the British Government used to issue, which had gilded edges.

How do gilts work?

Let’s use two examples of gilts that are currently in issue:

4.125 % Treasury gilt 29/1/27

You, the investor, can buy this gilt from someone who wishes to sell it. At the time of writing (16 September 2024) you can buy one unit of this gilt for £1.0075. If you decide to hold it until the gilt matures, which for this gilt is the 29/1/27, then the government will pay you back £1.00 for each gilt.

In the meantime, an investor will also receive 4.125% interest from this gilt. This percentage figure is called the coupon and is paid twice a year, on dates six months apart. Therefore, if you held 1 unit of this gilt, you would receive 2.0625p every six months.

The total return on this gilt is 3.78% annualised before tax.

0.375% Treasury Gilt 22/10/2026

Everything works in the same way as the above, except that with this gilt you only receive 0.375% in interest as opposed to 4.125% with the 29/1/27 gilt. Why would you ever buy the second gilt over the first? Because of the much lower coupon, an investor will only accept paying a lower price for this gilt and at the time of writing this is £0.93513 for 1 unit of this gilt. When the gilt matures, you will receive back £1 for each unit, as well as the small amount of interest.

The total return on this gilt is 3.61% annualised before tax.

Why are gilts attractive now?

As we have seen much higher inflation over the last few years, this has led to a corresponding rise in gilt yields and interest rates, which is beneficial for savers. However, gilts have one main advantage over typical bank savings accounts, especially for higher and additional rate taxpayers.

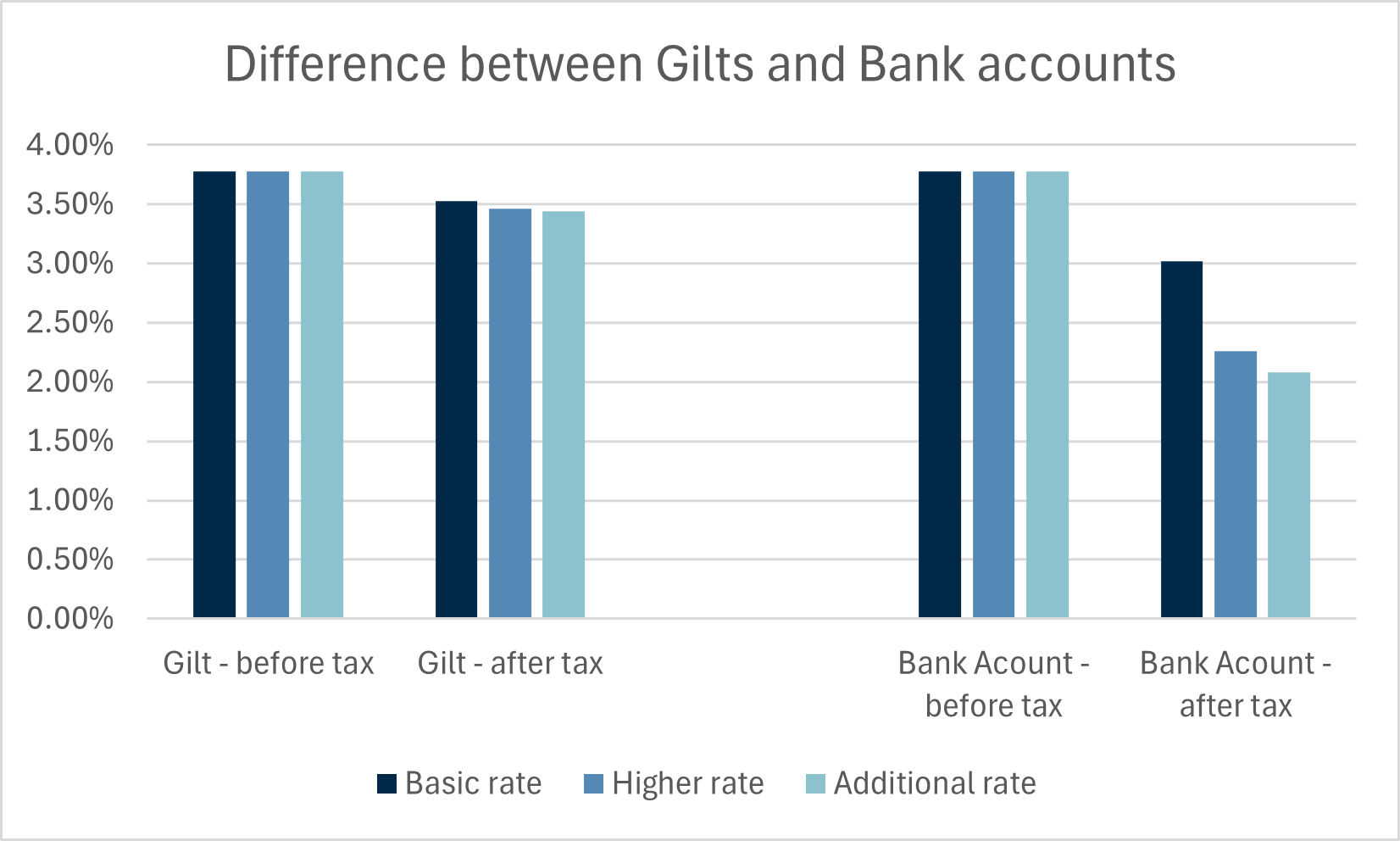

Bank savings accounts: Ignoring any allowances or tax wrappers that UK residents may make use of, a saver will have to pay tax at their marginal rate of income tax (20%,40% or 45%) on any interest generated. This means that if your cash deposits earn £100, and you are a 40% taxpayer, you only keep £60 of this £100. If we assume an interest rate of 3.78% (for comparison purposes the same as the first gilt), this would equate to an after-tax return of only 2.15%.

Gilt holder: Although any income from gilts is taxable at an investors marginal rate of tax in the same way as bank interest, any capital gain is tax free. Therefore, comparing the two highlighted gilts, the 0.375% gilt is more tax-efficient because an investor will only pay tax on the 0.375% interest, while the capital gain from the purchase price (£0.93513) to £1 at maturity is not taxed.

This means that, while the 4.125% gilt falls to an after-tax return of 2.15%, the 0.375% gilt has an after-tax return of 3.46%, only a fraction less than the quoted 3.61%. You can see the difference in after-tax returns of this tax-efficient gilt vs a traditional bank account for different taxpayers in the chart below.

If you would like to discuss gilts or other investment concepts, please don’t hesitate to get in touch with us.

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.