Compounding is a fundamental principle when it comes to investing and creating wealth.

Compounding is the idea that if you invest money into something and it grows over time, its value can increase exponentially. In other words, it might not seem to grow very much at the start, but eventually it gains momentum.

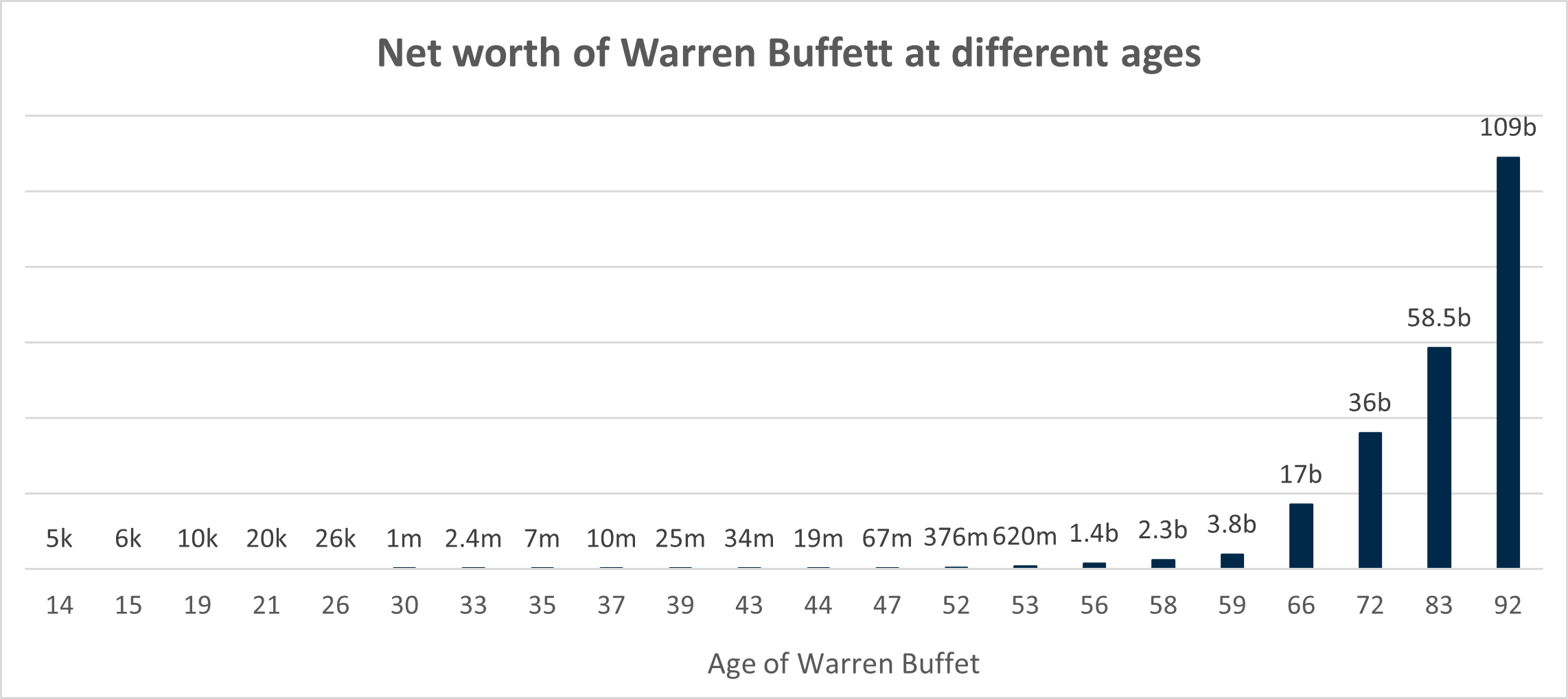

The legendary investor Warren Buffett is a champion of compounding and described it as building a little snowball and rolling it down a very long hill. As the snowball rolls down the hill, it collects more and more snow until it becomes a huge snowball.

At an annual shareholders’ meeting, when someone asked him how they could make billions of dollars, Buffet said, “The trick is to have a very long hill, which means starting very young or living…to be very old”.

Buffet made his first investment at the age of 11 and he is now 94.

How compounding works

It’s best to demonstrate with an example. Imagine you have an ordinary bank account.

- You put £100 into the account.

- The bank pays you 5% interest i.e. £5.

- After one year, you have £105 in the bank. So far, so good.

- Another year passes and the bank pays you 5%.

- This time, you earn 5% on £105.

- So you earn £5.25 interest in that year. A whopping 25p more than the year before.

- The 25p is what you have earned from compounding.

Ok we know these numbers are nothing to write home about…yet. But they illustrate the concept.

The thing is, over a short period of time, the money grows by small amounts and it might seem it’s not worth bothering. But over longer periods of time, the effect can be dramatic.

When does compounding start to make a significant difference?

The short answer is that compounding takes time.

If we turn back to Warren Buffet, according to Forbes, he is currently the eighth richest person in the world with a net worth of approx. $140bn. However, most of his fortune was accumulated after his 65th birthday.

Source: Finmasters – Warren Buffett’s net worth over the years

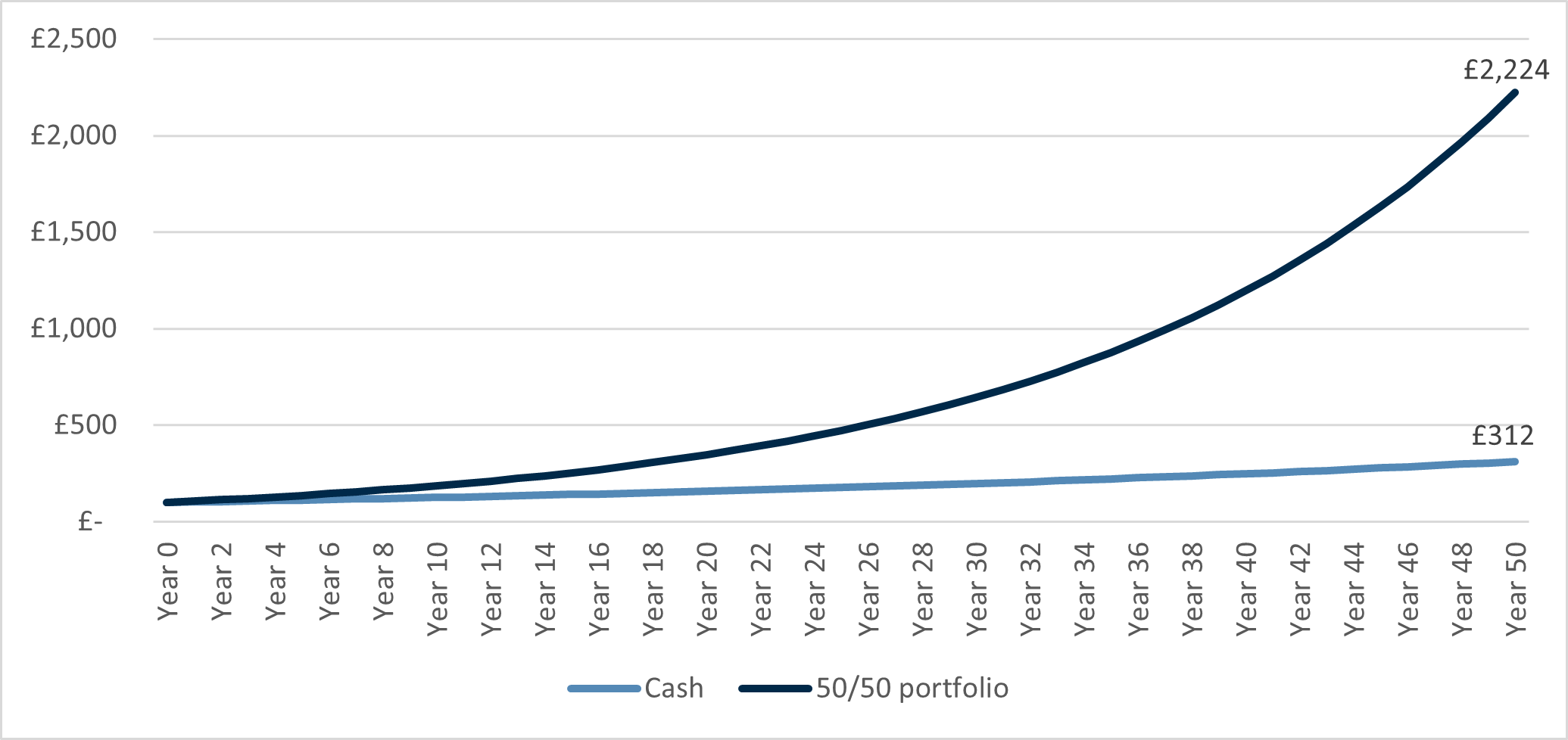

To illustrate the power of compounding, we decided to compare two £100 pots and see how they would grow over time.

We put £100 into each pot. In the first pot, the £100 is kept as cash in a deposit account or put into cash equivalents (such as Treasury bills). In the second pot, the £100 is fairly conservatively invested (50% government bonds, 50% US stock market).

After some very basic and crude assumptions, the pots would start behaving something like the below chart.

Source: Barclays, Raymond James

Initially, the difference between the pots is not that evident. The navy and the light blue lines are close together.

It is after 10 years that we start seeing a sizeable gap between the two lines emerging, demonstrating the potential benefits of investing and compounding. After 10 years, the invested pot is about 48% larger than the cash pot. After 20 years, it is 119% larger. After 30 years, it is 225% larger.

In reality, the invested pot wouldn’t go up so smoothly. The navy line would be much bumpier. Investments rarely grow at a fixed percentage every year (wouldn’t that be nice!). But over a long timeframe, like 20 years, you could expect an upward trajectory.

What can you do in practice

Compounding takes time. It is a way to build wealth slowly. How can you harness the power of compounding?

- Start investing early

For the snowball to gain pace and grow, you need a long hill. Create a long hill by starting to invest early.

A great place for young people to start is often by contributing to their workplace pensions. The contributions may feel small and insignificant. But if you are prepared to wait, the contributions could – quite literally – pay dividends.

- Invest for the next generation

To give compounding a longer runway, you can invest for your children or grandchildren.

We have an article on investing for children here.

- Don’t interrupt compounding

Warren Buffett’s long-term business partner and friend, Charlie Munger, once said: “The first rule of compounding, never interrupt it unnecessarily”.

In other words, once you have put your money to work, try to hold onto your investments for as long as possible. This is particularly pertinent during periods of market stress when it is easy to panic sell. It is important to keep a cool head, being patient and staying disciplined.

At Raymond James, Fulham we really enjoy picking investments that we think are long-term compounders. If you would like to discuss investing or anything in this article, please don’t hesitate to get in touch.

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.