Welcome to our Education series that aims to explain various investment concepts in a friendly, clear and precise format. Here, we take a look at the ISA.

The letters stand for Individual Savings Account. While the name may sound fancy, the concept is actually simple. It’s an account where your cash or investments are shielded from most taxes associated with cash and investments – income, dividend and capital gains tax. This means that your money in the account can grow without having to pay these taxes.

Who can open an ISA?

If you are over 18 years old and a UK resident (including members of the armed forces and Crown servants), then you can open an ISA.

The ISA is always in sole name – it can’t be in joint name.

How much can you put into an ISA?

There is a limit to how much you can put into an ISA. At the moment, the limit is £20,000. This is called the ‘ISA allowance’ and it renews every tax year. This means that every year, you have the option to contribute into an ISA.

It’s often described as ‘use it or lose it’ because you can’t carry it forward to another year. If you don’t contribute this year, any unused allowance is lost – your allowance doesn’t increase next year. Instead, you get the same allowance as everyone else.

What is an ISA subscription?

It is when you contribute money into an ISA. If you put £15,000 into your ISA, you have made a £15,000 ISA subscription.

When does the tax year start and end?

In the UK, the tax year runs from 6 April to 5 April. Ah yes, it would have been much more straightforward if the tax year started on 1 January. So why the quirky dates? We will leave that for another article.

The key point to remember is that your annual ISA allowance renews every tax year. So you can contribute up to £20,000 (in total) between 6 April and 5 April.

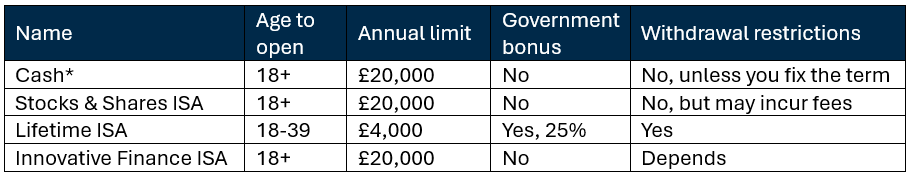

Different types of ISA

There are different types of ISAs. They are like a family. Below is a brief overview of the current options.

*In 2024, the minimum age for cash ISAs was raised from 16 to 18. As a transitional measure, if you were born between 6 April 2006 and 5 April 2008, you can open one cash ISA before you turn 18.

Your ISA allowance can be put into a single account or split across multiple accounts.

At Raymond James, we offer Stocks & Shares ISA. For children under the age of 18, we offer Junior ISAs (more information about Junior ISAs and investing for children can be found here).

What is a Stocks & Shares ISA?

This type of ISA allows you to hold investments. At Raymond James, your ISA can be invested in collectives, shares or bonds (including gilts).

You can transfer an existing Cash ISA into a Stocks & Shares ISA. This usually involves speaking to the new ISA provider and completing an ISA transfer form. Do not withdraw the money yourself to make the transfer – this takes the money out of the ISA, losing the ISA tax benefits.

If you would like to discuss ISA transfers, please don’t hesitate to contact us.

What is a flexible ISA?

A flexible ISA has an additional benefit to a standard ISA. The ‘flexibility’ is a special feature that some (but not all) providers offer.

With a flexible ISA, if you take any money out of it, you can put that money back in during the same tax year. This is on top of your ISA allowance.

It’s best to illustrate this feature with an example. Let’s say Ken has £80,000 in a standard ISA:

- He decides to withdraw £70,000 for house renovations.

- There is now £10,000 in his ISA.

- Ken wants to top up his ISA. Since this is a standard ISA, he can only contribute a maximum of £20,000, his annual ISA allowance.

- There would now be £30,000 in Ken’s ISA.

How does this compare to a flexible ISA? If Ken had £80,000 in a flexible ISA and withdrew £70,000, then:

- There would be £10,000 in his ISA.

- If Ken wanted to top it up, he could:

- Put back £70,000 into the ISA (as long as it was in the same tax year as the withdrawal).

- Put in £20,000, his annual ISA allowance.

- As a result, Ken’s ISA would be £100,000.

Having a flexible ISA can be very beneficial and we are proud that Raymond James’s Stocks & Shares ISAs are flexible.

If you would like to discuss ISAs or your wider personal finances in a confidential setting, please don’t hesitate to get in touch.

Risk warning: With investing, your capital is at risk. Tax treatment depends on individual circumstances and may be subject to change. Opinions constitute our judgement as of this date and are subject to change without warning. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.