Welcome to our Education series that aims to explain various investment concepts in a friendly, clear, and precise format.

Here we look at a much-debated asset class: Cash. We are defining cash as cash in bank accounts, cash ISAs, fixed term cash accounts, premium bonds and even bank notes buried under the squeaky floorboard in the kitchen.

“Cash is King” vs “Cash is a wasting asset”

These two phrases are often mentioned when discussing the pros and cons of holding cash, so which one is true when it comes to investment? In truth, we think both statements hold true, and we will endeavour to explain our thoughts.

Cash is King

There are several instances where we would recommend investors hold cash. These include:

- Big foreseeable expenses that are coming up in the next couple of years.

These could be a holiday, a wedding/civil partnership, or property renovations.

- A rainy day fund.

This is an emergency fund which is used for, well, emergencies. You may lose your job, need to replace a boiler or need to repair your car.

These are the main reasons investors need to have a cash reserve. Naturally, the next question is: How much is enough?

Looking at the big foreseeable expenses is easy. If you have a £3,000 holiday coming up, you would aim to hold £3,000 to fund it. You can try and be smart and put £2,884 in a cash savings account at 4% p.a. 12 months before needing the £3,000, but in principle you are matching your upcoming expense.

The rainy day fund is a little harder to quantify as there are plenty of variables to consider. Someone with three children to support and who works as a commodity trader (a particularly high-risk job) may wish to hold more cash than a single man with a job as a tenured law professor. There is no hard and fast rule, and we would encourage a discussion with clients as to what the right amount is for each individual or family unit.

However, as a rough rule of thumb, we would generally recommend holding 6-12 months of your expenditure in the rainy day pot.

Cash is a wasting asset

There is no denying that cash, as a long-term asset, has its value eroded by inflation. As long as clients have a sufficient rainy day pot and no large upcoming expenses, then we would not look to hold cash as a longer-term investment.

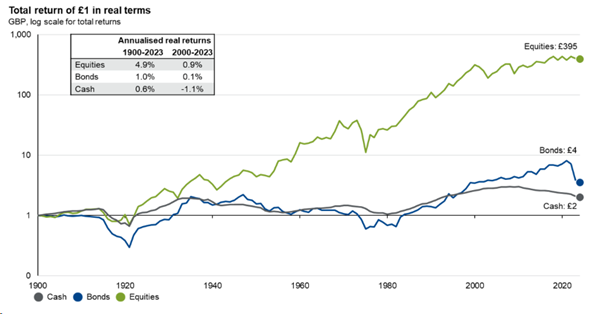

If we look at the below chart, we can see that over the longer term, cash is the worst performing asset between equities, bonds and cash.

In today’s world of inflation, the numbers can be truly frightening when we consider the impact of inflation of how much you can buy with your cash (the cash’s “purchasing power”). Please use the useful link below to see how much your cash is worth in the future at various levels of inflation.

https://www.rl360.com/row/tools/inflation-calculator.htm

Make cash work for you

We will finish this article by highlighting that if you do wish to hold cash, please make it work for you.

The worst thing you can do is to hold large quantity of cash in a duffel bag under your bed. This way, you run the risks of misplacing it, theft, inflation, all coupled with no interest being paid to negate inflation. We would recommend putting money with various banks, trying to stay under the £85,000 FSCS limit, while also shopping round for a decent interest rate.

As always, Raymond James, Fulham are here for you and will be happy to discuss this in more detail.

Risk Warning: This blog is intended for information purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person. Your capital is at risk when investing.