ISAs can be great accounts. Your cash and investments are shielded from most taxes – income, dividend and capital gains tax. This means that money in the ISA can grow without you having to pay these taxes. But there is a limit to how much you can put into an ISA, currently £20,000. Here, we look at some of the options available once you have contributed the maximum into the ISA.

For an overview of ISAs, please check out our article here.

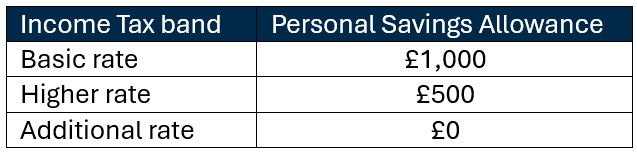

The first key consideration is whether you are looking for a place for your cash or your investments. With cash, there are some allowances that you can make use of such as the Personal Savings Allowance. When it comes to investments, you could consider other tax wrappers available to you.

Personal Savings Allowance

This is an amount of interest that you can earn tax-free (unless you are an additional-rate tax payer in which case the allowance is nil!). Interest can be earned from cash in the bank, corporate bonds or gilts.

If you have a joint account, then interest will be split equally between the account holders. If you think it should be split differently, contact HMRC.

Starting rate for savings

This is for non-taxpayers and some basic-rate taxpayers. If this is not you, then if you are married or in a civil partnership, it is worth considering whether it applies to your spouse. If your spouse is eligible for the starting rate for savings, then you could consider holding more savings in their name. Be aware that when you move money into your spouse’s name, it will be legally in theirs from then on.

The starting rate of savings means that you can get up to £5,000 of interest tax-free. But it depends on your other income (e.g. wages, pension, rental income). The more you earn from other income, the less your starting rate for savings will be.

If your other income is £17,570 or more, you are not eligible for the starting rate for savings.

If your other income is less than £17,570, then you are eligible. Your maximum starting rate for savings is £5,000. Every £1 of other income above the Personal Allowance reduces your starting rate for savings by £1.

Here is an example:

- You earn £15,570 in wages and get £1,500 interest on your savings.

- Your Personal Allowance is £12,570. It’s used up by the first £12,570 of your wages.

- The remaining £3,000 of your wages (£15,570 – £12,570) reduces your starting rate from £5,000 to £2,000.

- This means that you can earn up to £2,000 interest tax-free under the starting rate for savings. In other words, you don’t need to pay tax on your £1,500 of savings interest.

Premium Bonds

These are an option if you are looking for a place for your cash. Premium Bonds are essentially a savings account, but you don’t receive interest. Instead, you are entered into a monthly draw. If you win something, the winnings are tax-free.

Premium Bonds are issued by National Savings and Investments (NS&I), the UK government savings bank. You get a unique bond number for every £1 invested. So if you invest £100, you’ll get 100 bond numbers, each with an equal chance of winning a prize. A few things worth noting:

- You’ll need to invest at least £25.

- The maximum amount you can hold is £50,000.

- You need to hold the bonds for a full month before they are entered into the draw. So if you bought the bonds in September, they’ll be in the draw in November.

- Prizes up for grabs range from £25 to £1million every month.

Gilts

Gilts are UK government bonds. They can pay interest, but their significant advantage is that they are exempt from capital gains tax – so any uplift in price is tax-free. Buying gilts where most of the return comes from capital growth can be a very tax efficient option, especially for higher- and additional-rate taxpayers.

For an overview of gilts, please check out our article here.

Spouse’s ISA

If you are married or in a civil partnership, you could see whether your spouse has used their ISA allowance. If not, you could top up their ISA. But be aware that your spouse’s ISA is in their name and if you top it up with your own money, then the amount will legally be theirs from then on.

Pension contributions

Pensions are valuable wrappers. If you have room within your annual allowance, you could top up your pension and receive tax relief (a cash injection from the government).

You could also consider doing the same for your spouse. When looking at a couple’s finances, the pensions are often lop-sided – one person has a much larger pension than the other. This often means that when a couple comes to drawing on their pensions, the bulk of the withdrawals come from one pot. The majority of pension withdrawals are taxable, and this could push the person providing most of the retirement income into a higher tax band. When both pensions are of a similar size, the withdrawals can be spread across the pots and potentially more tax efficient.

Topping up your spouse’s pension comes with the usual caveat – once in your spouse’s pension, the money will be legally theirs from then on.

If you have maxed out your ISA and would like to discuss your options, please don’t hesitate to get in touch with us.

Risk warning: With investing, your capital is at risk. Tax treatment depends on individual circumstances and may be subject to change. Opinions constitute our judgement as of this date and are subject to change without warning. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.